In the beginning, God provided for us in the Garden. When we decided to turn from God, we were kicked out of the Garden. Instead of allowing rock bottom to hit and turn back to God, we decided to push through creating technology and secular cities to continue our rebellion away from God.

The city starkly contrasts the Garden, where there was Abundance and Freedom, achieving Peace through God’s Grace and Mercy. We moved to a secular form of governance where the main principles are Scarcity and Fear, achieving “Order” (instead of Peace) through the Debt and Forced Control of man. We exchanged the Truth of God for the Lie of man.

People soon discovered they were more blessed with certain God-given resources and skills than others. This led to exchanging goods (physical creations) and services (doing something for someone). Even though God has given us these gifts freely, we chose Trade over Charity.

Bartering

The first step in trade is called bartering. If I have an excess of apples and want oranges, I can barter my apples for someone else’s oranges. Bartering only takes the two main parties to complete the transaction. The apples and the oranges are in the private sector and were never brought into the public through registration in commerce. So, if the resources are not intended for the public, and you are using no form of money to hold the energy from the transaction, there is no need for any other parties to be involved. No one’s time, service, or energy needs to be used. Therefore, there doesn’t need to be any “cost” associated. There is no one else bringing any value to the transaction.

The main problem with bartering was sometimes you didn’t have anything of interest to the person you wanted something from. You wanted oranges, but all you had to offer was apples, and the person with oranges didn’t want any apples. So, our only option was to find out what the person with the oranges wanted. Let’s say they wanted pears. So we could find someone with pears and trade our apples for them. Then, we will return to the person with the oranges and trade our newly acquired pears for their oranges. And that’s only if the guy with oranges still wanted pears, and the person with pears wanted our apples. To make exchanges easier, we used something that everyone valued: Gold. Gold was the first medium of energy exchange. Gold was the first form of money.

Precious Metals

This brought us to our next issue: While gold is a tangible asset universally agreed to be valuable… it’s finite. Which means there’s only so much of it. So, the economy can only expand as far as there is gold to expand. Gold can only be fractionalized so much. You can’t just give a gold coin to buy a pencil. This is when we had to go to other precious metals such as silver and copper. This worked for a while, but the economy and population grew and grew, creating deflation. This caused a few problems: 1. The cost of making even these cheap copper coins far outweighed the price for regular everyday small exchanges, and 2. If the purchasing power of money keeps rising due to scarcity, it stifles trade because waiting on your purchase will effectively make it cost less. This leads to hoarding and creates a significant disparity between the haves and the have-nots.

Another issue was that people would shave off the edges of coins to collect precious metals without the coins looking too small. This is why some coins today have those ridges on the edge, so you know if you’re getting a coin containing less value due to shaving the edges.

Paper Certificates Backed On Gold

We then created Paper debt instruments because the paper was easier to carry, easier to fractionalize, and pieces could not be shaved off, diminishing their value. The paper money that we use today is a continuation of this practice. It was initially created as an IOU (I Owe You). A Gold Certificate was redeemable at the bank that issued it. So whoever had the note could call due to the bank’s debt, and the bank would exchange the public debt for private gold.

This brought inefficiency as well. There were many different banks and banknotes that all needed to be trusted. Who knew if they were just creating fake, baseless, intangible IOUs? Another issue is that you could only redeem the gold locally. So, using the IOUs as anything but a local currency was difficult. As civilization expanded, so did area-specific specialization and trade. Just as Florida specializes in oranges, and Idaho specializes in potatoes. It’s not so bad if the seller travels selling their products because they are in the area the bank is in for redemption… but it gets more difficult if you’re away from the issuing bank trying to buy something.

Fractional Reserve Lending

These debt instruments did so well that barely anyone redeemed them for gold. But bankers and other financial companies started lending out money they didn’t even have so they could make interest on this “fake” gold. Back in 1907, certain institutions were allowed to make loans that were backed by practically nothing at all. These were used to purchase securities and call loans. They provided uncollateralized loans, basically fake money, used as liquidity in the stock exchange through various other securities and debt instruments. When there was a run on deposits there was no money to back up the certificates. They were lending with only 5% in reserves. Meaning they only needed to have $5 to lend $100. This uncollateralized lending or “Fractional Reserve Lending” process led to the Panic of 1907.

Creation of the Federal Reserve

Because of the Panic of 1907, a Private Organization called the Federal Reserve Central Bank was established to better regulate and stop market volatility, preventing both inflationary and deflationary recessions and depressions. Providing a single central governing body to manage the creation of money and the banking system seemed like the best answer at the time.

But unfortunately, as with all Communistic Centrally Controlled ideology, it’s just not practical. It’s both ineffective and inefficient. The Federal Reserve Central Bank was created to stop Recessions and Depressions. Market volatility was supposed to be a thing of the past, but Centralized control proved ineffective at preventing recessions or depressions. The Great Depression hit about 15 years after its creation, and most of those reading this have lived through the 2008 recession and have experienced plenty of market volatility since then. The Federal Reserve Central Bank has also been very inefficient in managing the creation of our money. It also has a relatively steep cost of 3% inflation as a “good” target number. And we have all experienced far more than that. Just look at the increased cost of groceries and other commodities over your life. A 10-dollar bill doesn’t go as far as it used to. That is inflation at work. That is the Federal Reserve Bank’s Inefficiency revealing itself. And once again, it was the best we could do then. The middlemen were required. Real time and energy had to be expended to create the currency, regulate it, and figure out what was best for everyone while doing a lot of guessing.

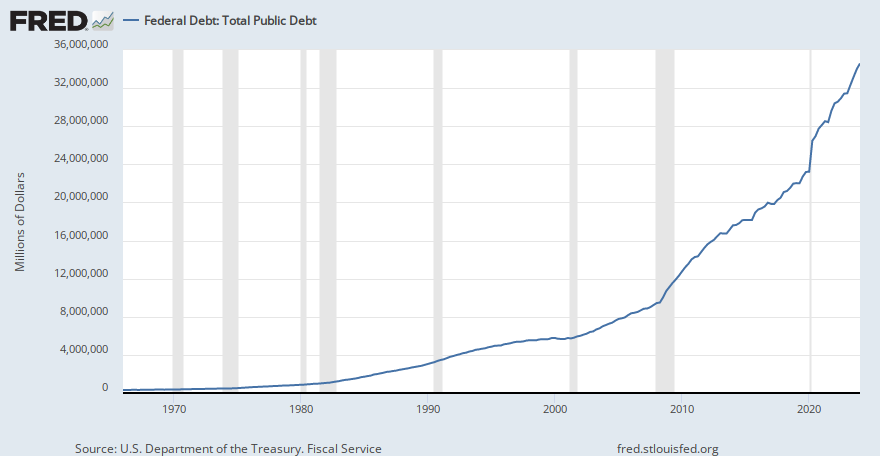

There were many problems with this part of the system. For one, interest creates the effect of an exponential growth function. And if you don’t know what an exponential function graph looks like, it’s called a “hockey stick” graph for a reason. Exponential growth is not sustainable. It will consolidate everything to the very top, then collapse. But again, it’s the best we had.

Fiat Currency (Backed on Nothing)

Another issue we ran into was the fractional reserve centralized banking system, creating debt out of thin air. Banks only needed to hold 20% reserves, and at times much less. That means that in the most simplistic example, only 20% of the money in circulation was backed by gold. And that’s if these loans were not deposited again or used in other debt instruments, which would create even more uncollateralized fake money. Since the Federal Reserve Banking System is inherently inflationary it is impossible to just magically create more gold to keep up with it. Gold is finite, there is only so much that has been mined and only so much more that can be mined. So, for the monetary system to grow as fast as it was, the gold standard would have to be done away with. Because of this, we created the Federal Reserve Note. These looked the same as the US Dollar but were legally wholly different. They were no longer redeemable for gold because Federal Reserve Notes were no longer tied to gold. We could effectively print as much uncollateralized fake money as the Federal Reserve Central Bank chose to.

Eventually, in 1971, we would make the sever of the dollar from Gold 100% official and public. It wasn’t just no longer backing our money with gold, but we would no longer have the value tied to it at all. This took us into a new age of volatility, exponential growth, and new debt instruments.

And because the Federal Reserve Central Bank is inherently inflationary, the question is not IF we will eventually get to hyperinflation but WHEN.

Digital Credit

Credit has the same relationship that paper money used to have with gold, but instead of the value of real gold backing paper money, valueless paper money is what is backing credit. The credit bubbles that grow are like those empty vaults, but worse. If “3%” inflation leads to an inevitable collapse… imagine what adding another fake form of currency at 21%+ interest would do… 70/3= 23.33 years to cut purchasing power in half. 70/21= 3.33 years to cut purchasing power in half… Not good.

Crypto Currency

And now, we are in another transition period. Blockchain technology has brought us to a digital currency called cryptocurrency. There are some huge bonuses and similar pitfalls with the main Cryptocurrencies. Most cryptocurrencies, such as Bitcoin and Ethereum, are created with a finite amount of coins to preserve integrity and fend off inflation. This will have a deflationary effect. At least there is no issue with fractionalizing the coins for smaller purchases. However, the main problem is that purchasing power will continue to increase as more people use them. This could stifle energy exchange because it’s more definitively finite than gold (you can’t mine more eventually). When you know those coins will be more valuable next year, why should I spend them now? It acts better as an investment instrument than a means for energy exchange. Another drawback of current cryptocurrency is that it’s backed by absolutely NOTHING. It’s not collateralized at all. That means if people no longer believe in it, the value will drop to ZERO.

LND Coin and Share Credits

It comes down to the things that are usually mutually exclusive: either it’s a good investment (appreciating) instrument or a good energy exchange (depreciating) instrument. Share is both. It’s a combination of (LND Coin and Share Credits). The benefits of an appreciating instrument (purchasing power continually increases) while having all of the benefits of a depreciating instrument, such as a federal reserve note (dollar), without either side’s drawbacks. You have a long-term appreciating tangible asset with real intrinsic value, yet you are still liquid. You retain the total purchasing power as if you never let your money leave your investment. Land as an investment has historically been a high-yield and safe asset. While a business can go out of business, land cannot go out of land. Land can’t reach zero. Not to mention, you don’t have to feel that conscience nag of supporting organizations such as Black Rock that do less than moral endeavors with your savings and investment accounts that they get to use.