In the beginning, God provided for humanity in the Garden. But when we turned away, we were removed from that place of abundance. Rather than returning to God, humanity continued on a path of creating technology and secular cities, moving further from divine connection.

The city marks a departure from the peace of God’s Garden, where abundance and freedom flourished. In its place, we built systems that rely on scarcity and debt to enforce man-made “order,” replacing the divine peace that once existed. We exchanged the truth of God for the lie of man.

Over time, people recognized that God-given resources and skills varied. Even though we received these gifts from God freely, this led to exchanging goods and services, replacing charity with trade.

Bartering

The earliest form of trade was bartering. For instance, if someone had extra apples and wanted oranges, they could trade their apples with someone who had oranges. This system only involved two parties, with no public record or monetary exchange, meaning there was no “cost” to the trade. However, a key limitation soon emerged: if one person didn’t have what the other wanted, indirect trades became necessary, complicating transactions. To streamline trade, people eventually turned to gold, a universally valued medium of exchange.

Precious Metals

Gold was the first widely accepted form of “money,” but as economies expanded, it became inadequate on its own. While gold is a tangible asset universally recognized as valuable, it is finite and can only be divided so much. You can’t exactly use a gold coin to buy something as small as a pencil. To address this, other metals like silver and copper were introduced, but they too posed problems as populations grew. The scarcity of these metals led to deflation, discouraging trade and creating an incentive to hoard. This halted economic cooperation and further deepened the divide between the rich and the poor.

Coin shaving, where people trimmed metal from coins for profit, also created issues. To prevent this, ridges were added to coin edges—a feature still seen on some coins today.

Paper Certificates Backed On Gold

To make transactions easier, people began using paper certificates backed by gold. These certificates, essentially IOUs, could be redeemed for gold at the local issuing bank. While paper notes were more convenient and easier to divide than gold, the system introduced issues of trust. Banknote fraud became a concern, and traveling to another city posed challenges, as different banks issued their own notes, creating inconsistency and undermining confidence in the system.

Fractional Reserve Lending

Paper money worked so well that people rarely redeemed it for gold, which led banks to issue more paper certificates than they had gold to back. By 1907, banks were holding only a fraction of the gold reserves necessary to cover their loans, setting the stage for a crisis when depositors suddenly demanded their money. This practice, known as “fractional reserve lending,” played a significant role in triggering the Panic of 1907.

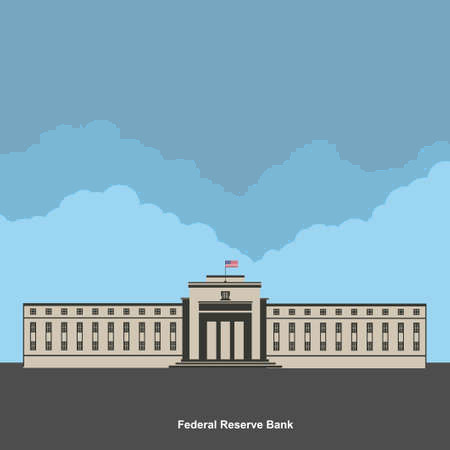

Creation of the Federal Reserve

The Panic of 1907 led to the creation of the Federal Reserve, a central bank meant to stabilize the economy. It was designed to control money creation, prevent recessions, and maintain economic stability. However, centralized control proved inefficient, and ineffective. The Great Depression occurred less than 15 years later, with multiple recessions and ongoing inflation demonstrating that Communistic centralized control cannot prevent economic instability.

Inflation has been a persistent issue in all debt-based currencies. Although the Federal Reserve targets a 3% inflation rate, many goods and services have experienced price increases far exceeding that, revealing the steady erosion of the dollar’s purchasing power and the inherent inefficiencies of the system. Yet, this was the best we could do at the time. Middlemen were necessary, and real time and effort were spent creating, regulating, and managing the currency—with no possible way to know what was truly best for everyone.

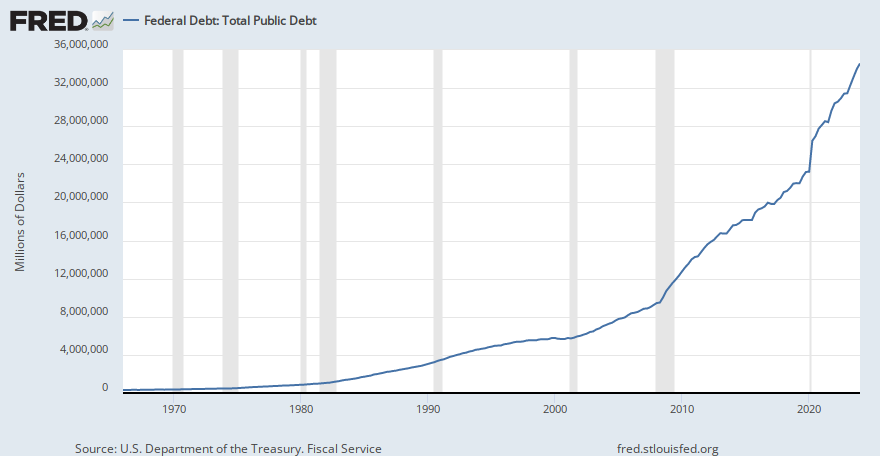

There were many issues with this part of the system. One major problem is that interest leads to exponential growth. If you’re unfamiliar with exponential growth, imagine a “hockey stick” graph—it starts slowly, but quickly shoots upwards. This type of growth is unsustainable; it inevitably concentrates wealth at the very top, until it eventually collapses. Even a modest 3% growth rate each year will, over time, lead to the same outcome: a system that cannot endure. But, once again, it was the best we had at the time.

Fiat Currency (Backed on Nothing)

Another major issue was the fractional reserve lending, which allowed banks to create debt out of thin air. Banks were only required to hold a fraction—typically 20%—of their reserves, and at times much less. In the simplest terms, this meant that only 20% of the money in circulation was actually backed by gold. And that’s assuming these loans weren’t redeposited or used in other financial instruments, which would create even more uncollateralized, “fake” money.

Since the Federal Reserve Banking System is inherently inflationary, it’s impossible to create more gold to keep up with the growing money supply. Gold is finite—there’s only so much that has been mined, and only so much more can be mined. As the economy grew, the gold standard simply couldn’t keep pace. So, to accommodate this growth, the gold standard was abandoned, and the Federal Reserve Note was introduced. While these notes looked similar to U.S. dollars, they were legally completely different. They were no longer redeemable for gold because Federal Reserve Notes are not backed by gold, even though their value was “pegged” to gold. This allowed the Federal Reserve to effectively print as much uncollateralized money as it saw fit, without any physical backing.

As the economy expanded, the gold standard became increasingly unsustainable, and in 1971, the dollar was completely detached from gold. It was no longer backed by or pegged to the value of gold in any way. Since then, the dollar has become a fiat currency, meaning its value is based solely on trust and government decree, rather than any tangible asset. This shift has ushered in new periods of economic volatility and rising debt.

And because the Federal Reserve Central Bank is inherently inflationary, the question is not IF we will eventually get to hyperinflation but WHEN.

Digital Credit

Credit now serves a similar role to what paper money once did with gold. But instead of being backed by a tangible asset like gold, credit is backed by nothing of real value—just valueless paper money. The credit bubbles that form are like empty vaults, but worse. If a 3% inflation rate inevitably leads to collapse over time, imagine the damage of adding another layer of fake currency with 21%+ interest rates.

To put this in perspective, at 3% inflation, it would take roughly 23.33 years to halve the purchasing power of your money. But at 21% interest, that same effect would occur in just 3.33 years. Clearly, this is a recipe for economic instability.

Crypto Currency

We are now entering another period of transition, as blockchain technology has ushered in the era of cryptocurrency. While cryptocurrencies like Bitcoin and Ethereum offer significant advantages, they also come with similar challenges. One major benefit is Cryptocurrencies also don’t have to deal with fractionalization issues. Another benefit is that many cryptocurrencies are designed with a finite supply, which helps preserve value and prevent inflation.

However, the key problem with some cryptocurrency is their deflationary nature. As cryptocurrencies gain popularity, their purchasing power is likely to increase over time. This would discourage spending and hinder economic exchange, as people may choose to hold onto their coins, expecting them to be worth more in the future. In this sense, cryptocurrencies may function better as investment vehicles rather than mediums of exchange, much like gold, but with an even more definite limit since, unlike gold, no more coins can be mined once the supply cap is reached.

Another significant drawback is that cryptocurrencies are not backed by any physical asset or collateral. This means that if trust in the system falters or demand wanes, their value could collapse entirely—essentially dropping to zero.

LND Coin and Share Credits

It all comes down to the classic trade-off between two typically mutually exclusive qualities: an appreciating asset (best for investment) and a depreciating asset (best for energy exchange). Share brings together the best of both, without the drawbacks of either. It combines the long-term growth potential of an appreciating asset, like LND Coin (backed by land), with the liquidity, flexibility, and collaborative incentives of a depreciating asset, such as Share Credits (pegged to the dollar). This hybrid model allows you to benefit from the tangible, intrinsic value of a growing asset, while still being able to use it as currency when needed. It’s like sharing your apples without ever having to give away the apple tree.

Essentially, Share allows you to preserve the full growth potential of your investment without sacrificing liquidity. Unlike traditional investments, which often lock up your capital or expose you to market volatility, Share enables you to retain both your wealth and your spending power, all while maintaining security and flexibility.

Land, for example, has historically been a high-yield, low-risk asset. Unlike businesses, which can fail, land can never “go out of land” and its value can never drop to zero. It’s a safe, appreciating asset. Moreover, with Share, you avoid the ethical concerns of supporting large corporations like BlackRock, which often invest your savings in ways that may not align with your values. With Share, you keep control over your investment without feeling complicit in questionable practices.